The New Intelligence Paradigm in Dealmaking

Imagine having an associate who never sleeps, can read thousands of pages in minutes, remembers every detail perfectly, and reasons through complex problems with the precision of a seasoned banker. That's what Claude 3.7 can bring to M&A.

The release of Anthropic's Claude 3.7 "Sonnet" represents a major leap forward in AI for dealmaking. As a platform built to boost a deal team's natural advantages through technology, we at Deliverables AI have been closely tracking these advancements and their implications for investment bankers, private equity professionals, and corporate development teams.

What makes Claude 3.7 so transformative? It's the first true hybrid reasoning model on the market – combining the speed of traditional large language models with the depth of step-by-step reasoning systems. For dealmakers drowning in information and racing against time, this fundamentally changes how deal intelligence can be gathered, analyzed, and leveraged.

In this article, we'll explore what Claude 3.7 brings to the table, how it empowers vertical AI platforms in finance and M&A, and what it means for the future of dealmaking. Whether you're already using AI in your deal process or just beginning to explore its potential, Claude 3.7's capabilities signal a new era that no dealmaker can afford to ignore.

Why Claude 3.7 Sonnet is a Game-Changer for Deal Intelligence

Claude 3.7 "Sonnet" stands apart from previous AI models by functioning as what Anthropic calls "the first hybrid reasoning model on the market." Unlike conventional LLMs that only predict text or specialized "reasoning" models that think step-by-step, Claude 3.7 combines both approaches in a single system.

This might sound technical, but the real-world benefits are substantial. Think about the difference between asking a junior analyst a quick factual question versus tasking them with a complex analysis that requires deep thought. Traditionally, different types of AI would be better at one task or the other – but Claude 3.7 excels at both.

The model can function as a fast, responsive assistant for straightforward queries, or it can switch into an "extended thinking" mode for deeper, step-by-step reasoning. This unified approach means the AI can quickly handle simple questions like "What was the target's EBITDA last year?" while also tackling complex problems like "How do the synergies justify the valuation premium?" by self-reflecting before answering – all within the same session.

But hybrid reasoning is just one piece of the puzzle. Claude 3.7 brings several other improvements that make it particularly valuable for M&A professionals:

Understanding context and following instructions with precision

Anthropic has trained Claude 3.7 with a focus on real-world business tasks rather than just academic puzzles. The result is a model that demonstrates a nuanced understanding of instructions and can draw insights from complex, unstructured data.

The model is significantly better at understanding context and following instructions precisely, with lower rates of hallucination – making it more reliable for factual Q&A on large knowledge bases. This is critical when analyzing legal contracts or financial statements where accuracy is paramount.

For M&A professionals, this means less time spent correcting AI-generated outputs and greater confidence in the information being provided. When every detail matters in a transaction, having an AI assistant that consistently delivers accurate, on-point responses becomes invaluable.

Advanced reasoning capabilities for complex deal analysis

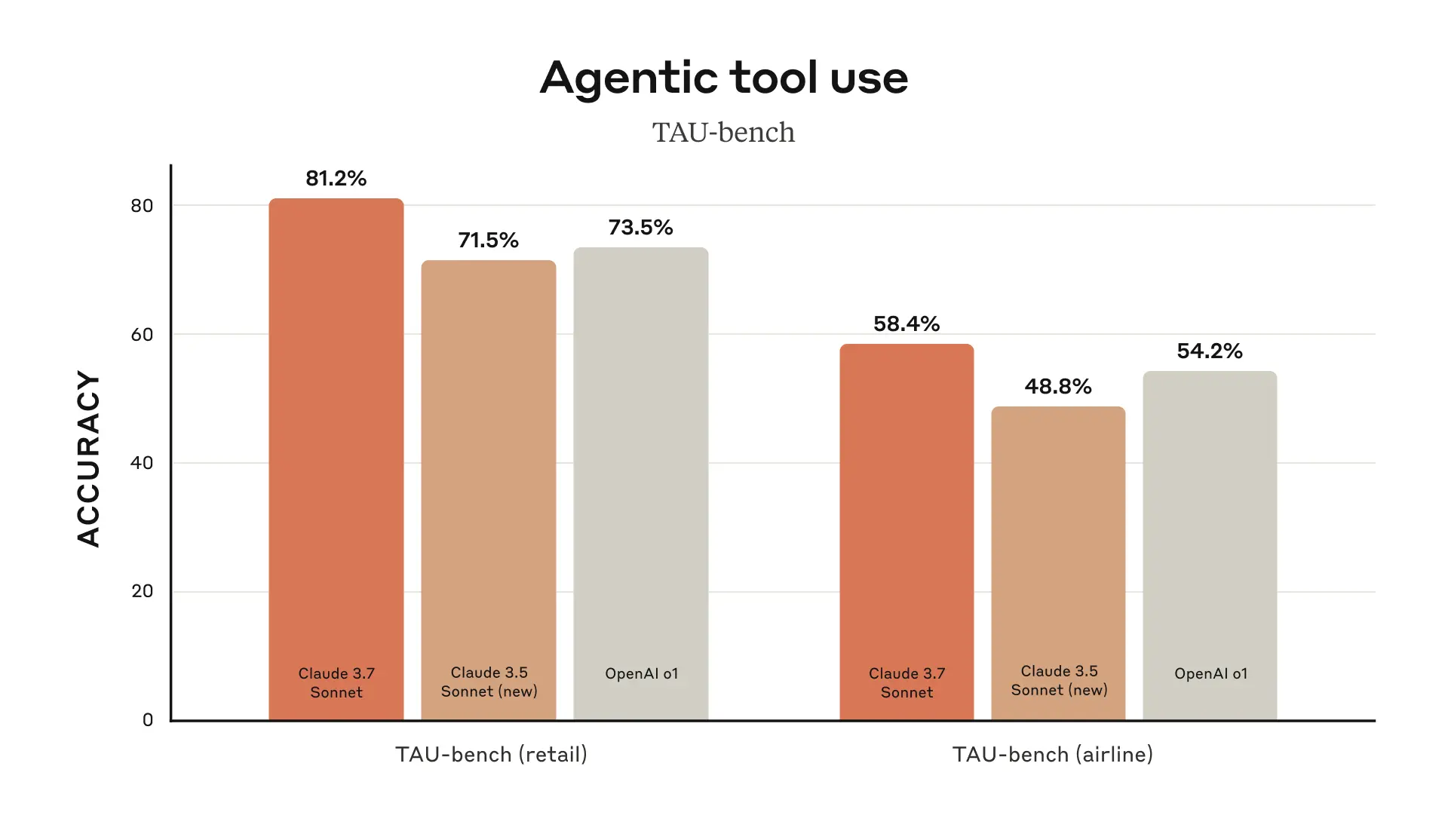

In head-to-head comparisons, Claude 3.7 has achieved top scores on TAU-bench (which evaluates how well AI handles complex tasks with tools and user interactions) and on SWE-bench (which tests solving real-world software issues). It even outperformed OpenAI's latest GPT-4 Turbo on certain coding and "agentic" benchmarks – 70.3% vs. 48.9% on a software engineering test, and 81% vs. 73% on an AI agent task test.

For M&A applications, these improvements mean better performance on multi-step logic, financial analysis, and structured problem-solving – exactly the skills needed for effective deal analysis. Whether calculating financial ratios, identifying red flags in contracts, or assessing market positioning, Claude 3.7's reasoning capabilities enable more sophisticated and reliable outputs.

Lengthy, detailed responses in a single generation

One of Claude 3.7's standout features is its ability to generate extremely long, detailed responses in a single pass. Unlike previous models that might cut off mid-analysis or require multiple prompts to complete a thorough response, Claude 3.7 can produce comprehensive documents, detailed analyses, and extended reasoning chains all at once.

For dealmakers, this means the model can draft complete sections of pitch books, investment memos, or due diligence reports without constantly hitting output limits. When you ask for a detailed competitive landscape analysis or a comprehensive summary of a target's growth strategy, you'll get the complete picture in one coherent response – not fragments that need to be stitched together.

How Claude 3.7 Elevates Vertical AI Platforms in M&A

Vertical AI agents are specialized systems tailored to industries like finance, law, or healthcare. In M&A, a vertical AI platform (such as Deliverables AI's deal intelligence assistant) needs to comprehend vast amounts of deal-specific data, reason about complex business scenarios, and produce outputs that align with industry norms and objectives.

Claude 3.7's advancements directly enhance these capabilities in several key ways:

Deeper document understanding transforms due diligence

M&A transactions involve massive document flows – financial statements, legal contracts, due diligence reports, market studies, emails, and more. Claude 3.7's improved natural language processing allows it to analyze these extensive materials with remarkable thoroughness.

The model can intake complex documents and retain context throughout, rather than breaking analysis into disconnected chunks. This means an AI agent can understand the target company's story holistically, recognizing subtle connections such as links between a footnote in the financials and a clause in a contract.

Anthropic specifically notes that Claude 3.7 "can understand nuanced instructions and context... and create sophisticated analysis from complex data" – exactly the challenge in parsing M&A documents. Furthermore, its low hallucination tendency reduces the risk of misinterpreting critical details, increasing accuracy in summarizing or extracting deal-relevant facts.

Enhanced reasoning capabilities that mimic expert analysis

Beyond reading documents, M&A analysis requires connecting dots and drawing conclusions – identifying key value drivers, spotting risks, comparing the target to competitors, and more. Claude 3.7's hybrid reasoning shines here.

In "extended thinking" mode, the AI can perform step-by-step analysis of a company's performance or simulate the thought process of an analyst. For instance, it could calculate and interpret financial ratios from raw statements, or follow a chain of logic to identify cause-and-effect relationships (e.g., how customer churn impacts revenue projections, and in turn, valuation).

This represents a leap from prior models that might give a quick answer but skip the deeper rationale. A hybrid model "dynamically switches between fast prediction and deep reasoning" as needed, which is ideal for domain-specific agents that encounter both straightforward questions and complex analytical challenges.

The result is more strategic insight generated by the AI. It can surface hidden value drivers or red flags that a busy deal team might overlook by thoroughly analyzing the data and context – something we at Deliverables AI explicitly aim to do.

High-context Q&A that transforms how teams access information

Vertical AI agents often serve as on-demand analysts, answering user questions about the deal. With Claude 3.7, if an investment banker asks, "Summarize the target's revenue by product over the last 5 years and any notable trends," the AI can scan through thousands of lines of financial data and narrative, and respond with a detailed, accurate answer citing the source data.

Its ability to produce lengthy, detailed responses in a single generation is particularly valuable here. When drafting sections of a pitch or investment memo, the model's advanced writing skills and context understanding help maintain consistency and relevance throughout long-form documents.

Claude 3.7 excels at "writing with nuance and tone to generate compelling content," which is crucial for creating polished deal narratives. It can adapt the tone for different audiences – such as a technical summary for an internal deal committee versus a story-driven pitch for a strategic buyer – while grounding the content in the factual data provided.

Dramatic efficiency gains that transform deal timelines

For M&A professionals, one of AI's biggest promises is speeding up workflows without sacrificing quality. The enhancements in Claude 3.7 directly translate to greater efficiency for domain agents.

Tasks that normally require days of manual work (e.g., reviewing a stack of contracts for change-of-control clauses, or compiling a competitor benchmarking analysis) can be accelerated dramatically. Early adopters of AI in M&A have already seen this effect: one mid-market advisory firm reported that with AI assistance, "what took 6 weeks now takes 10 days, and materials are consistently stronger."

With Claude 3.7's release, such gains are likely to deepen. The model's ability to handle real-world use cases means it's tuned for business tasks, not just textbook problems, making its output more immediately usable. Moreover, Claude 3.7 introduced fewer unnecessary refusals (45% reduction), meaning an AI agent will less often hit a dead-end when asked to perform an unusual but valid task.

Vertical AI agents can thus be trusted to automate more steps in the M&A process – from data extraction to first-draft analyses – freeing human experts to focus on high-level strategy and judgment.

Real-World Applications: Claude 3.7 in the M&A Workflow

Let's explore how these theoretical advantages translate into practical applications across different stages of a deal:

Due Diligence: From document overload to instant insights

In traditional due diligence, analysts spend countless hours manually reviewing documents, extracting key information, and identifying potential risks or opportunities. With Claude 3.7, this process is transformed.

Instead of manually reading through a data room, a deal team can ask the AI assistant questions like "List any contractual obligations that would trigger on change of ownership" or "What were the recurring revenue trends over the past 36 months?" Claude 3.7 can interpret these requests, scan the relevant documents, and provide concise answers with references to the source files.

This augments human diligence by catching details and doing it faster. While humans still make the final judgments, the AI eliminates hours of document scanning and information extraction.

Valuation & Modeling: Consistency checking and scenario analysis

While financial modeling still happens primarily in spreadsheets, Claude 3.7 can assist by reading model outputs or assumptions and checking consistency. For example, it could read a financial model's assumptions page alongside the LOI (Letter of Intent) terms and highlight inconsistencies – perhaps the model assumes an earn-out structure, but the LOI doesn't include one.

Its extended output generation means it could produce complete analyses in one go. It could help structure or sanity-check valuation narratives: "Explain why the proposed EBITDA multiple is justified compared to recent comparable deals," pulling in data from a comps database and writing a thorough justification without cutting off mid-analysis.

Competitive Analysis: Synthesizing market intelligence

Dealmakers could task Claude 3.7 with synthesizing competitive intelligence – uploading industry reports and recent M&A news and asking the AI to produce an overview of how the target stacks up against peers or what recent deals in the space have looked like.

Given Claude's strong performance in knowledge tasks, it might read multiple articles and produce a summary like "Competitor X was acquired at 5× revenue in a deal focusing on their European customer base, which suggests..." with source attributions. This gives bankers rapid situational awareness without hours of manual research.

Deal Structuring & Strategy: Drawing on institutional knowledge

By training Claude 3.7 on a library of past deal summaries or legal clause examples (all within a private environment), dealmakers could even have the model suggest potential deal structures or provisions based on historical patterns.

For instance, the AI might recognize that a seller is concerned about valuation and suggest an earn-out structure as a solution, explaining it in a draft email. Or it could generate a list of possible negotiation points to consider, based on similarities to prior deals.

While final decisions rest with humans, the AI can function as a knowledgeable advisor offering options – effectively capturing institutional knowledge in M&A and making it accessible to the entire team.

The Multi-Model Approach: Leveraging the Best of All AI Worlds

While Claude 3.7 brings tremendous capabilities to the table, it's worth noting that different AI models have different strengths. At Deliverables AI, we employ a multi-model strategy to ensure each task in the deal workflow uses the best available AI for the job.

Complementary strengths: Claude 3.7 and GPT-4

Claude 3.7 is a powerful engine for large-scale analysis and reasoning-heavy tasks, but it can be complemented by other models for different strengths. For example, GPT-4 excels in structured outputs and is more cost-efficient for certain types of tasks.

In practice, this means routing different types of queries to the appropriate model:

- When a user asks a detailed question requiring analysis of numerous sources or multi-step logic, Claude 3.7 can be deployed for its superior analytical depth and extended response generation.

- For tasks that need structured, consistent formatting or where cost efficiency is paramount, GPT-4 might be more appropriate.

By balancing different AI technologies, platforms can ensure optimal outcomes – analyzing deeper and moving faster for clients by using each model's strengths. The end result for the user is a seamless experience: they get answers and documents produced quickly and accurately, without needing to know which model did what behind the scenes.

The cost-benefit equation

One practical consideration is cost. GPT-4 Turbo's API pricing is reportedly 10×+ cheaper per token than Claude's. For organizations processing large volumes of text, this price difference matters.

A balanced approach might use Claude 3.7 for high-value, complex analytical tasks where its reasoning capabilities justify the premium, while leveraging more cost-efficient models for routine queries or content generation.

This isn't about cutting corners – it's about allocating AI resources effectively to maximize return on investment. Just as a deal team might assign different tasks to associates, VPs, and MDs based on their unique skills and cost structures, an intelligent AI platform can route queries to the optimal model.

Looking Ahead: The Future of AI in M&A

Claude 3.7 Sonnet is more than just a single model upgrade – it's a sign of how AI will continue to evolve and transform industry-specific workflows like mergers and acquisitions. Looking ahead, we can expect several trends:

Hybrid reasoning becomes the industry standard

The success of Claude's integrated reasoning approach may influence the entire AI landscape. We're likely to see other AI leaders follow suit with their own hybrid reasoning implementations.

Industry watchers predict that future models from OpenAI, Google, and others might adopt similar techniques, blending fast predictive power with an ability to think more deliberately when needed. For end users in M&A, this means future AI agents will be even better at handling the diverse nature of deal-making tasks – seamlessly transitioning from quick Q&A to heavy analysis as the context demands.

The line between a "chatbot" and an "autonomous analyst" will blur as models can do both in one package.

Multimodal capabilities expand

Future vertical AI solutions will likely handle tables, figures, and even financial models natively. Claude 3.7 already handles structured data like charts better than previous models, and we can expect its successors to broaden this capability.

In a few years, an M&A AI might directly process not just text but also Excel files or PowerPoint slides, interpreting them within the context of a deal. The ability to work across different data formats will make these tools even more valuable for the document-heavy world of M&A.

Widespread adoption transforms the industry

Currently, only a fraction of dealmakers use AI in their process. An Accenture study in 2024 found just 16% adoption of generative AI in M&A, but that number is projected to rise to 80% in the next three years. As models like Claude 3.7 demonstrate tangible benefits – cutting diligence time by 75% or producing instant draft documents – resistance to adoption will erode.

According to research from Accenture, 64% of M&A executives are confident generative AI will transform the deal process in the next few years.

We'll see AI move from a novelty to a standard part of the M&A toolkit, much like spreadsheets or virtual data rooms are today. Early adopters have shown AI can help "win more mandates by analyzing deeper and moving faster," and those competitive advantages will drive industry-wide uptake.

Of course, trust will be built on continued improvements in accuracy and safeguards. Each new model is likely to be more transparent and reliable, helping deal teams feel comfortable relying on AI for critical analyses.

Vertical AI solutions evolve to cover more of the deal lifecycle

Vertical platforms focused on M&A will themselves evolve in tandem with model advancements. The playbook will expand as AI takes on more of the deal lifecycle.

We may see AI co-pilots not only assisting in analysis and document prep, but also in areas like deal sourcing (scanning the market for likely acquisition targets using AI pattern recognition) or integration planning (helping map out post-merger integration steps by analyzing both companies' org charts and processes).

The future belongs to nimble, tech-enabled deal teams that can leverage these advancements to outperform larger, less adaptable competitors. With each new AI generation, the gap between AI-augmented teams and traditional approaches will widen.

Balancing AI Power with Human Judgment in the Deal Process

As we embrace these powerful new AI capabilities, an important principle remains: technology should amplify human expertise, not replace it. The most successful implementations of Claude 3.7 and other advanced models will be those that enhance what makes great dealmakers exceptional.

In practice, this means using AI to:

- Handle the heavy lifting of information processing, freeing humans to focus on strategy and relationship building

- Surface insights that might otherwise be missed due to time constraints or information overload

- Generate first drafts of analyses and documents that humans can then refine and customize

- Answer factual questions quickly so dealmakers can make informed decisions faster

- Maintain institutional knowledge across deals and team members

The goal isn't to automate dealmaking – it's to make dealmakers more effective by giving them tools that complement their natural advantages. Human judgment, creativity, emotional intelligence, and negotiation skills remain irreplaceable, but they can be applied more effectively when supported by AI that handles the information-intensive aspects of the job.

Conclusion: A New Era in Deal Intelligence

The arrival of Claude 3.7 Sonnet marks a turning point for AI in M&A. It brings us closer to AI that can truly augment human capabilities in deal-making – performing rigorous analysis, generating insights, and articulating findings in a way that amplifies what skilled professionals already do.

By combining sophisticated reasoning capabilities with the ability to produce comprehensive, detailed outputs in a single generation, Claude 3.7 enables dealmakers to process information faster, think more deeply, and communicate more effectively than ever before. The practical result: deals that move faster, analyses that dig deeper, and teams that can handle more complexity with confidence.

As we look to the future, one thing is clear: AI will play an increasingly central role in M&A, and advancements like Claude 3.7 Sonnet are paving the way for a new era of intelligent, efficient, and insightful dealmaking. The dealmakers who embrace these tools stand to gain a strategic edge – turning weeks into minutes, and information into advantage, in the competitive world of M&A.

The AI revolution in dealmaking isn't coming – it's already here. The question is no longer whether to adopt these technologies, but how to leverage them most effectively to stay ahead in an increasingly competitive landscape.